What is a Grant Deed?

A grant deed is a legal document that transfers ownership of real property from one person (the grantor) to another person (the grantee). Grant deeds are commonly used to sell real estate, but they can also be used to transfer ownership of real property for other reasons, such as gifting a property to a family member or transferring a property to a business partner.

Types of Grant Deeds

There are three main types of grant deeds:

- Full warranty deed

- Limited warranty deed

- Quitclaim deed

A full warranty deed is the most comprehensive type of grant deed. It provides the grantee with the most protection against any defects in the title to the property. A limited warranty deed provides less protection than a full warranty deed, but it still offers some protection against defects in the title. A quitclaim deed provides the least protection of all three types of grant deeds. It simply transfers whatever interest the grantor has in the property to the grantee, without any warranties or representations.

Requirements of a Grant Deed

In order to be valid, a grant deed must meet certain requirements. These requirements vary from state to state, but some of the most common requirements include the following:

- The grant deed must be in writing and signed by the grantor.

- The grant deed must be delivered to the grantee.

- The grant deed must contain a description of the property being transferred.

- The grant deed must be acknowledged by the grantor in front of a notary public.

Benefits of a Grant Deed

There are several benefits to using a grant deed to transfer real property. These benefits include:

- Grant deeds are relatively simple and inexpensive to prepare.

- Grant deeds are widely recognized and accepted by title companies and other real estate professionals.

- Grant deeds provide a clear and unambiguous way to transfer ownership of real property.

Drawbacks of a Grant Deed

There are some drawbacks to using a grant deed to transfer real property. These drawbacks include:

- Grant deeds do not provide as much protection against defects in the title to the property as other types of deeds, such as full warranty deeds.

- Grant deeds can be used to transfer property that is subject to liens or other encumbrances.

- Grant deeds can be used to transfer property that is not free and clear of all taxes and other assessments.

How to Prepare a Grant Deed

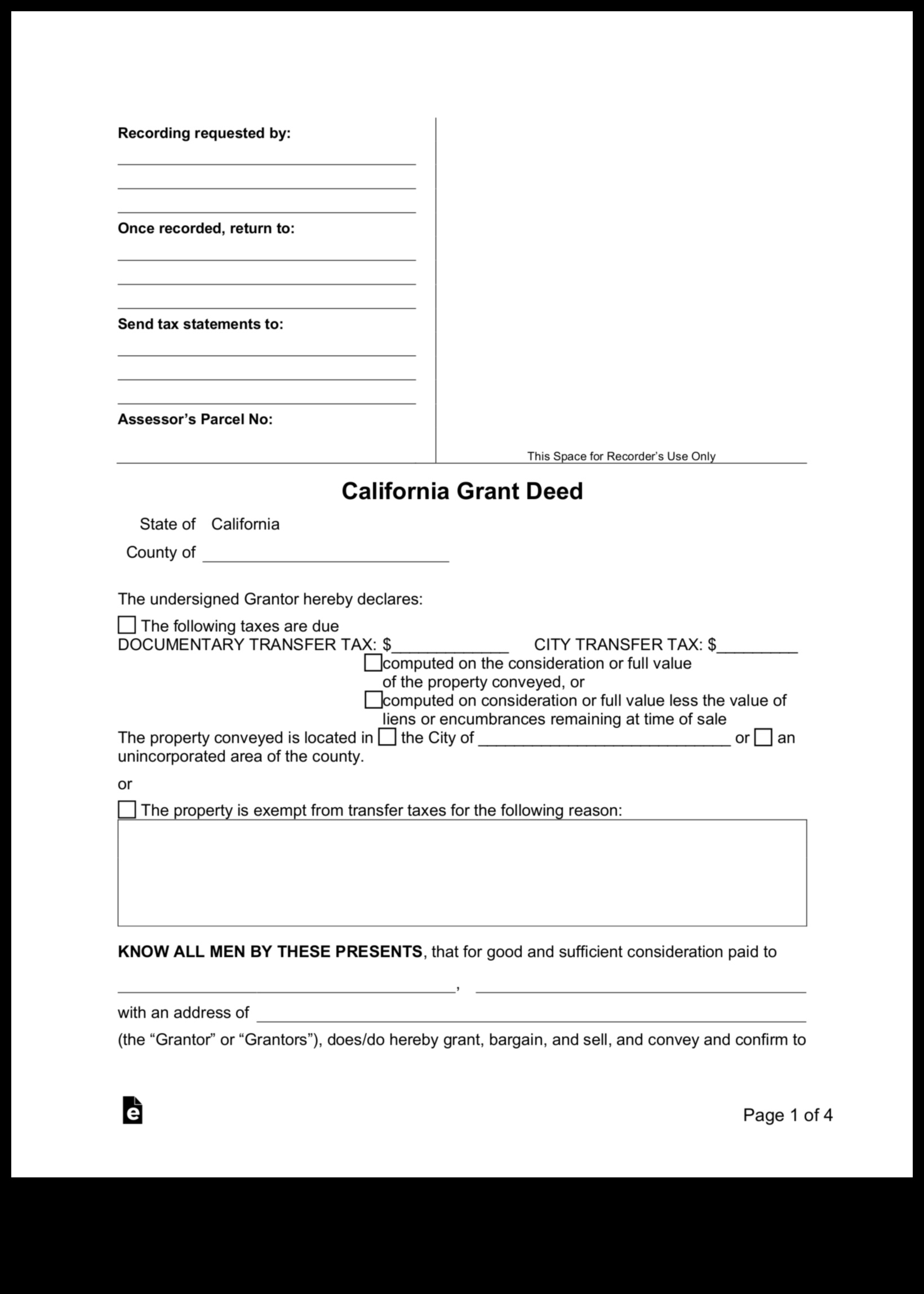

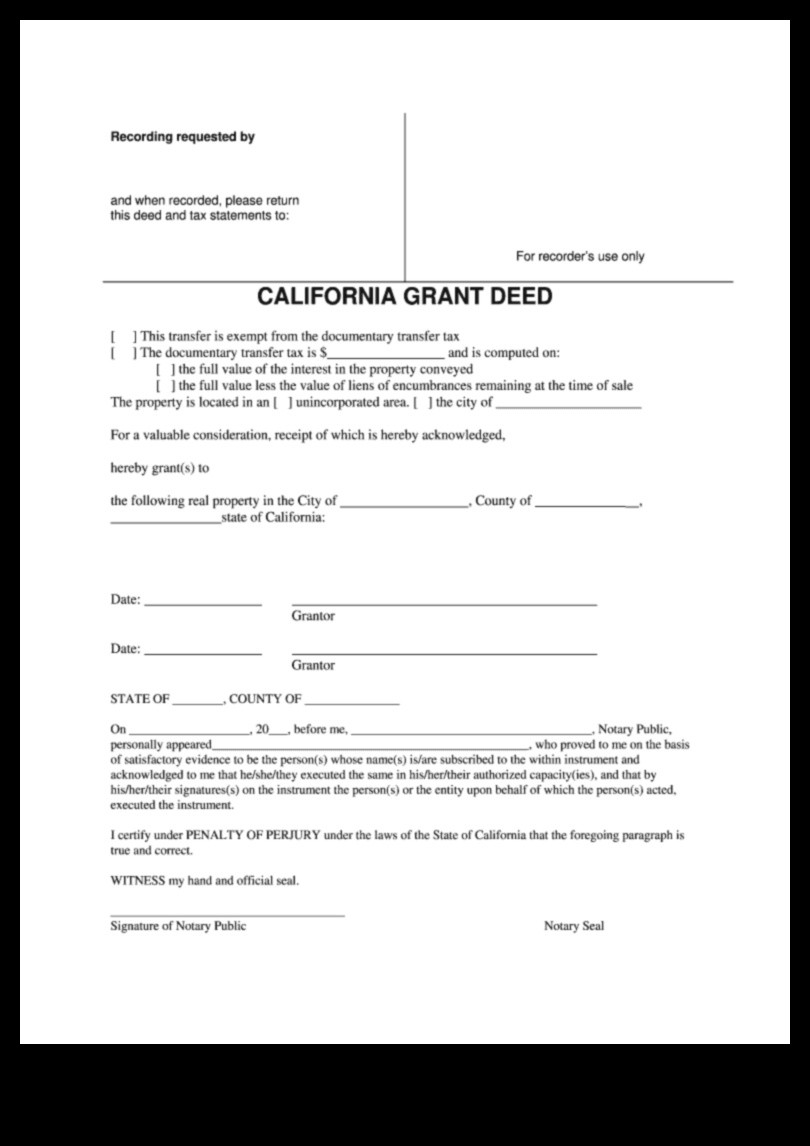

Preparing a grant deed is a relatively simple process. However, it is important to make sure that the grant deed is properly prepared in order to avoid any potential problems. The following steps can help you prepare a grant deed:

- Gather the necessary information. This includes the names of the grantor and the grantee, the description of the property being transferred, and the consideration being paid for the property.

- Draft the grant deed. There are many different forms of grant deeds available. You can use a form that you find online or you can work with an attorney to prepare a custom-drafted grant deed.

- Sign the grant deed. The grantor must sign the grant deed in front of a notary public.

- Record the grant deed. The grant deed must be recorded in the county where the property is located.

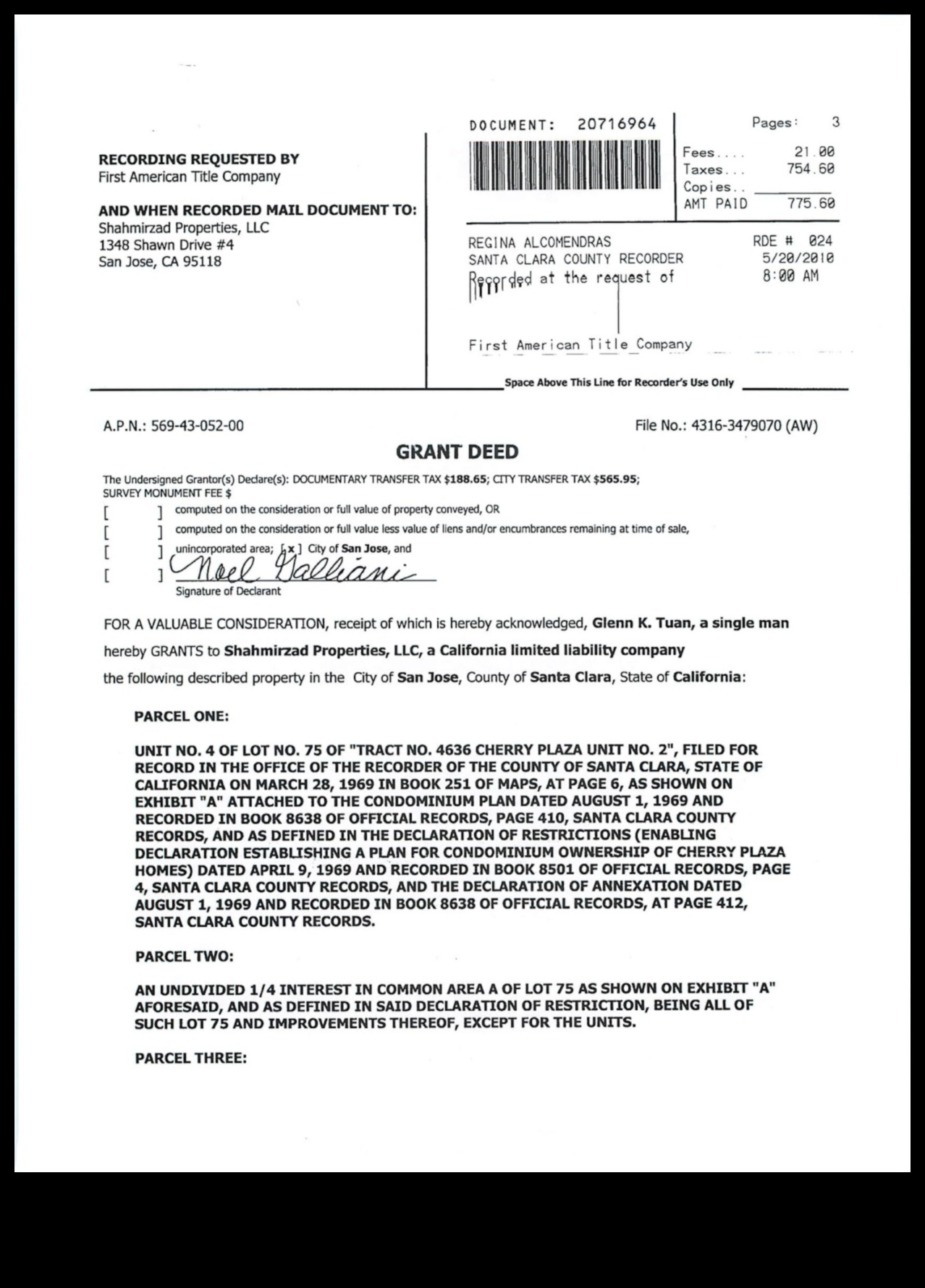

How to Record a Grant Deed

Recording a grant deed is the process of filing the grant deed with the county recorder’s office in the county where the property is located. Recording the grant deed serves two important purposes. First, it provides constructive notice to the world that the grantor has transferred ownership of the property to the grantee. Second, it creates a public record of the transfer of ownership.

To record a grant deed, you will need to bring the original grant de

| Feature | Grant Deed | Quitclaim Deed | Warranty Deed | Real Estate | Title Insurance |

|---|---|---|---|---|---|

| Definition | A grant deed is a legal document that transfers ownership of real property from one person to another. | A quitclaim deed is a legal document that transfers ownership of real property from one person to another, but it does not provide any warranties or guarantees about the condition of the property. | A warranty deed is a legal document that transfers ownership of real property from one person to another and provides certain warranties or guarantees about the condition of the property. | Real estate is a term used to describe land and the buildings on it. | Title insurance is a type of insurance that protects a property owner from financial losses that may occur due to defects in the title to their property. |

| Requirements | To create a valid grant deed, the following requirements must be met: | To create a valid quitclaim deed, the following requirements must be met: | To create a valid warranty deed, the following requirements must be met: | To purchase real estate, you must typically have a down payment and a mortgage loan. | To purchase title insurance, you will need to provide the following information: |

| Benefits | The benefits of using a grant deed include: | The benefits of using a quitclaim deed include: | The benefits of using a warranty deed include: | The benefits of owning real estate include: | The benefits of purchasing title insurance include: |

| Drawbacks | The drawbacks of using a grant deed include: | The drawbacks of using a quitclaim deed include: | The drawbacks of using a warranty deed include: | The drawbacks of owning real estate include: | The drawbacks of purchasing title insurance include: |

II. Types of Grant Deeds

There are three main types of grant deeds:

- A general warranty deed

- A special warranty deed

- A quitclaim deed

Each type of grant deed offers different levels of protection to the buyer and seller. A general warranty deed provides the most protection, while a quitclaim deed provides the least.

III. Requirements of a Grant Deed

A grant deed must meet certain requirements in order to be valid. These requirements include:

- The grantor must be the legal owner of the property being conveyed.

- The grantee must be a living person or a legally-recognized entity.

- The description of the property being conveyed must be clear and unambiguous.

- The grant deed must be signed by the grantor in the presence of a witness.

- The grant deed must be acknowledged before a notary public.

If any of these requirements are not met, the grant deed may be invalid.

IV. Benefits of a Grant Deed

There are several benefits to using a grant deed when transferring real property. These benefits include:

- A grant deed provides the grantee with a clear and concise title to the property.

- A grant deed is the most commonly used type of deed in real estate transactions.

- A grant deed is a relatively simple and inexpensive document to prepare and record.

- A grant deed provides the grantee with protection against any claims or liens against the property that existed prior to the date of the deed.

V. Drawbacks of a Grant Deed

There are a few drawbacks to using a grant deed to transfer real property. These include:

- A grant deed does not provide any warranties on the title to the property. This means that the grantor is not making any promises about the condition of the title or the existence of any liens or other encumbrances on the property.

- A grant deed does not provide for any right of redemption for the grantor. This means that the grantor cannot reclaim the property after it has been transferred to the grantee.

- A grant deed may be more difficult to record than other types of deeds, such as a quitclaim deed or a warranty deed. This is because a grant deed must be accompanied by a full chain of title showing all of the previous owners of the property.

Overall, grant deeds are a relatively simple and straightforward way to transfer real property. However, it is important to be aware of the potential drawbacks of using a grant deed before you decide to use one.

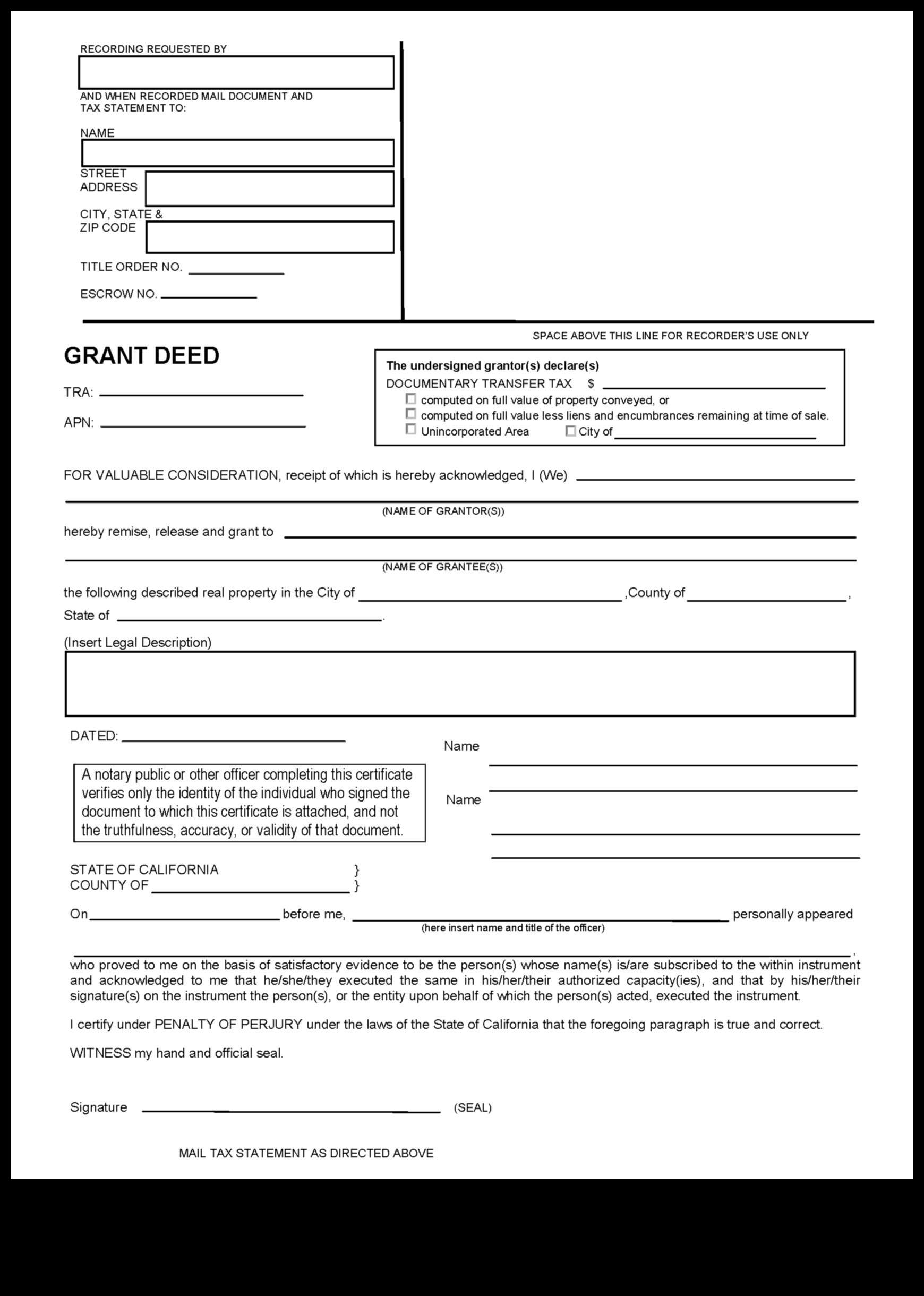

VI. How to Prepare a Grant Deed

A grant deed is a legal document that transfers ownership of real property from one person (the grantor) to another person (the grantee). The grantor must sign the grant deed in the presence of a witness, and the grantee must accept the deed by signing it. The grant deed must be recorded in the county where the property is located in order to be valid.

To prepare a grant deed, you will need the following information:

- The full names of the grantor and grantee

- The legal description of the property

- The consideration (i.e., the purchase price) for the sale

- The date of the sale

- The signatures of the grantor and grantee

You can prepare a grant deed yourself or you can hire a real estate attorney to do it for you. If you are preparing the grant deed yourself, you can use a template or form that is available online or from your local title company.

Once the grant deed is prepared, it must be signed by the grantor and grantee in the presence of a witness. The witness must also sign the grant deed.

The grant deed must then be recorded in the county where the property is located. The recording fee is typically around $20.

Once the grant deed is recorded, it is considered a public record and is available for anyone to inspect.

VII. How to Record a Grant Deed

To record a grant deed, you will need to:

- Obtain a copy of the grant deed from the grantor.

- Complete the recording form provided by the county recorder’s office.

- Pay the recording fee.

- File the grant deed with the county recorder’s office.

The recording fee typically ranges from $20 to $50. The time it takes to record a grant deed varies from county to county, but it typically takes one to two weeks.

Once the grant deed is recorded, it becomes a public record and is available for anyone to view. This means that the new owner of the property is now the legal owner of the property.

It is important to note that recording a grant deed does not automatically transfer title to the property. The new owner must also complete the process of transferring title to the property by following the steps outlined in the grant deed.

If you have any questions about recording a grant deed, you should contact the county recorder’s office.

Transferring Property with a Grant Deed

A grant deed is a legal document that transfers ownership of real property from one person to another. When a grant deed is used to transfer property, the grantor (the person who is transferring the property) conveys all of their interest in the property to the grantee (the person who is receiving the property). This means that the grantee becomes the sole owner of the property and has all of the rights and responsibilities associated with ownership.

In order to transfer property with a grant deed, the following steps must be taken:

- The grantor and grantee must sign the grant deed in the presence of a witness.

- The grant deed must be recorded in the county where the property is located.

- The grantee must pay the transfer taxes and other fees associated with the sale of the property.

Once the grant deed has been recorded, the grantee will be the legal owner of the property.

IX. Grant Deed FAQs

This section answers common questions about grant deeds.

What is the difference between a grant deed and a quitclaim deed?

A grant deed is a type of real estate deed that transfers ownership of a property from one person to another. A quitclaim deed, on the other hand, is a type of deed that simply releases any interest that the grantor (seller) has in the property. This means that the grantee (buyer) does not receive any warranty or guarantee that the property is free of liens or other encumbrances.

What are the requirements for a valid grant deed?

In order to be valid, a grant deed must meet certain legal requirements. These requirements typically include the following:

- The grantor must be the legal owner of the property.

- The grantee must be a legally capable person or entity.

- The property must be clearly described.

- The consideration (i.e., the purchase price) must be stated.

- The deed must be signed by the grantor in the presence of a witness.

- The deed must be acknowledged before a notary public.

What are the benefits of using a grant deed?

There are several benefits to using a grant deed, including:

- It is a simple and straightforward way to transfer ownership of a property.

- It does not require the grantee to provide any warranties or guarantees about the property.

- It is a relatively inexpensive way to transfer ownership of a property.

What are the drawbacks of using a grant deed?

There are also some drawbacks to using a grant deed, including:

- The grantee does not receive any warranty or guarantee that the property is free of liens or other encumbrances.

- The grantee may be responsible for any unpaid taxes or assessments on the property.

- The grantee may be responsible for any damages to the property that occurred before the transfer of ownership.

How do I prepare a grant deed?

Preparing a grant deed can be a complex process. It is important to work with an experienced real estate attorney to ensure that the deed is properly prepared and executed.

The following is a general overview of the steps involved in preparing a grant deed:

- Gather the necessary documents, including the property deed, the buyer’s and seller’s signatures, and the purchase price.

- Complete the grant deed form. Be sure to include all of the required information, such as the names of the grantor and grantee, the description of the property, and the consideration.

- Have the grantor sign the deed in the presence of a witness.

- Have the deed acknowledged before a notary public.

- Record the deed with the county recorder’s office.

How do I record a grant deed?

Recording a grant deed is the process of filing it with the county recorder’s office. This makes the deed public record and provides notice to the world that the property has been transferred to a new owner.

To record a grant deed, you will need to:

- Complete the recording form.

- Pay the recording fee.

- Provide a copy of the grant deed.

The recording fee is typically a few dollars. The time it takes to record a grant deed varies from county to county.

How do I transfer property with a grant deed?

Transferring property with a grant deed is a simple process.

Grant Deed FAQs

Q: What is a grant deed?

A: A grant deed is a legal document that transfers ownership of real property from one person to another.

Q: What are the different types of grant deeds?

A: There are three main types of grant deeds:

- Warranty deed

- Quitclaim deed

- Bargain and sale deed

Q: What are the requirements for a grant deed?

A: In order to be valid, a grant deed must include the following information:

- The names of the grantor and grantee

- A description of the property being transferred

- The consideration (i.e., the price) for the sale

- The signatures of the grantor and grantee