What is a Pell Grant?

A Pell Grant is a federal grant awarded to undergraduate students who demonstrate financial need. Pell Grants are awarded on a first-come, first-served basis, and the amount of the grant you receive is based on your family income and the number of other people in your household who are also enrolled in college.

Who is eligible for a Pell Grant?

To be eligible for a Pell Grant, you must be a U.S. citizen or permanent resident, and you must be enrolled in an eligible undergraduate degree or certificate program at an accredited college or university. You must also have a high school diploma or equivalent, and you must not have a bachelor’s degree.

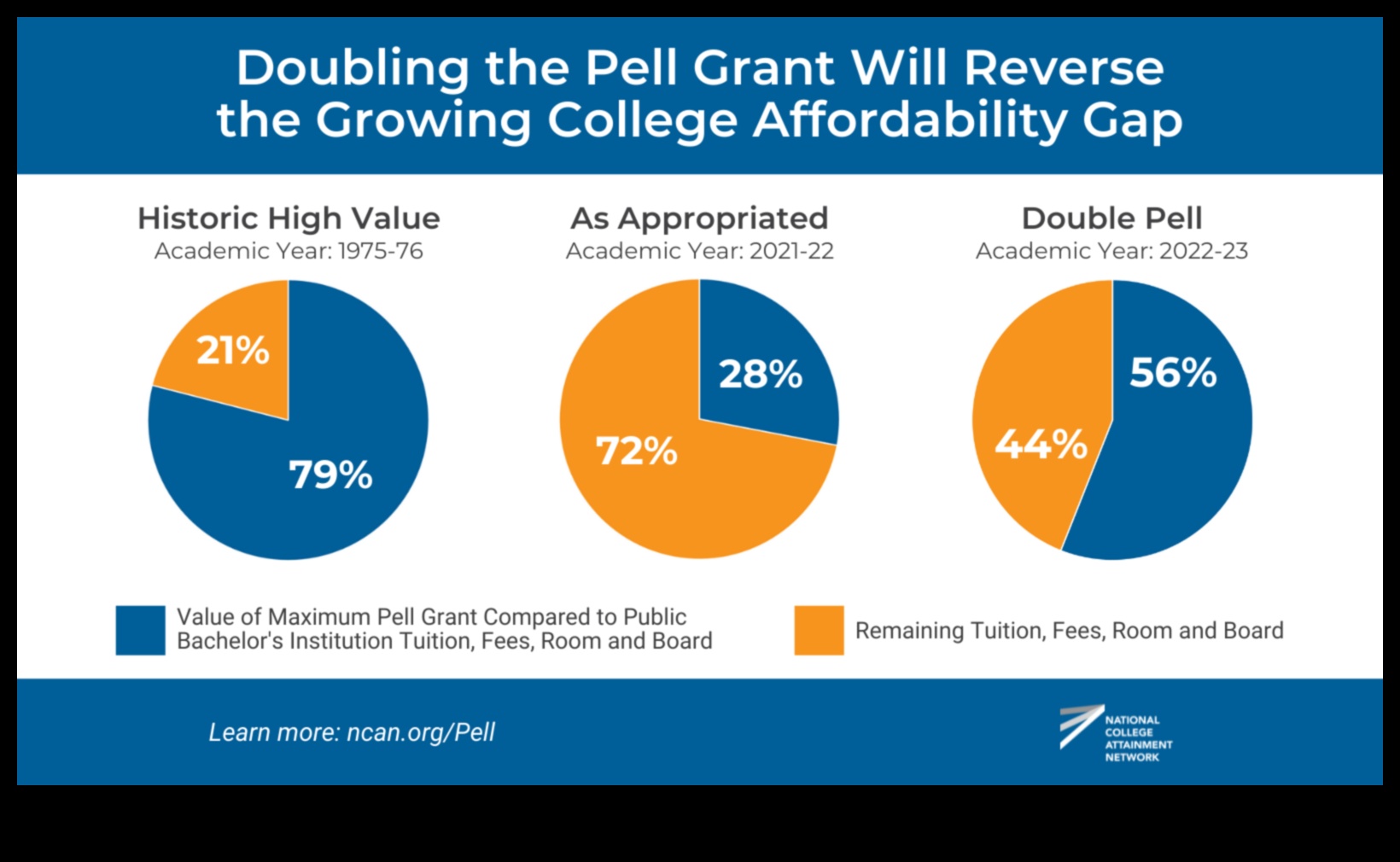

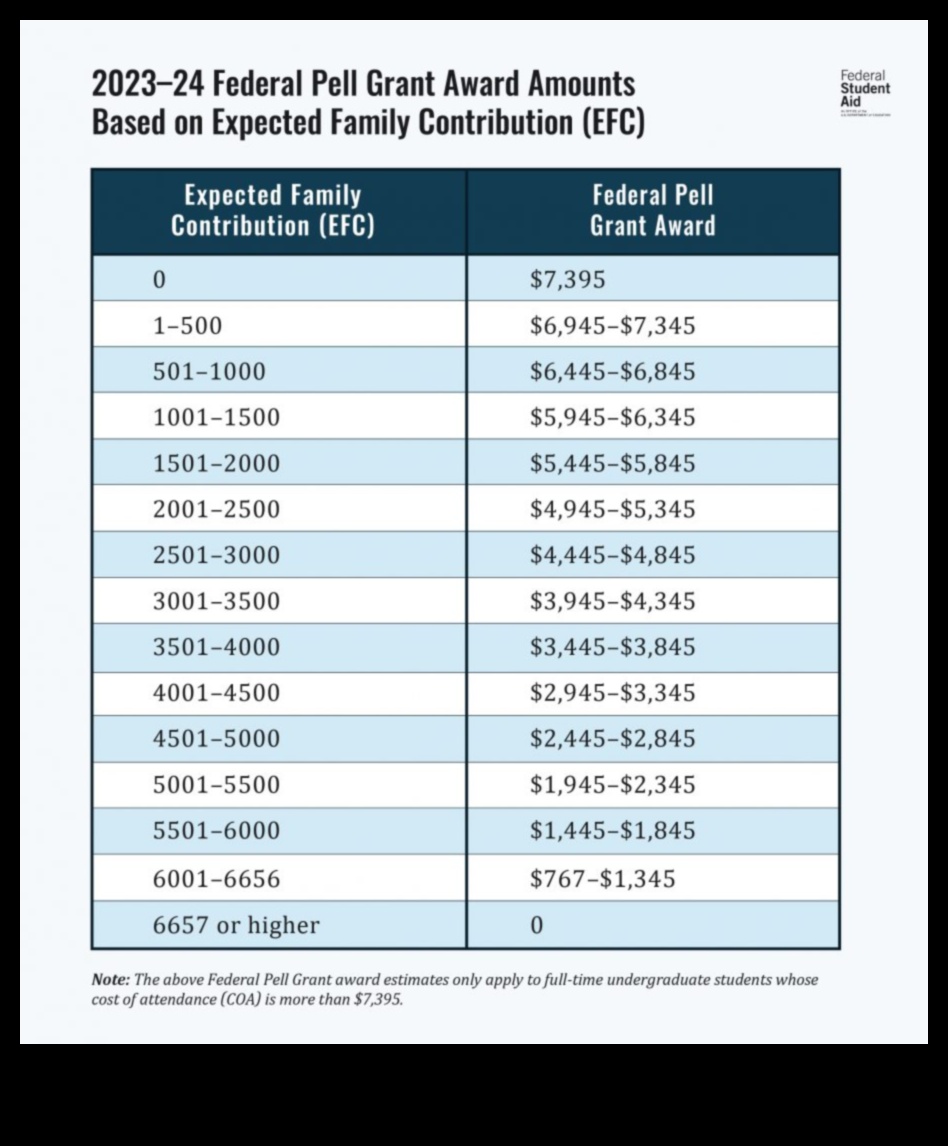

How much is a Pell Grant?

The maximum Pell Grant award for the 2022-2023 academic year is $6,495. However, the amount of the grant you receive will depend on your family income and the number of other people in your household who are also enrolled in college.

How do I apply for a Pell Grant?

To apply for a Pell Grant, you must fill out the Free Application for Federal Student Aid (FAFSA). The FAFSA is available online at fafsa.gov. You must submit your FAFSA by the priority deadline for your school to be considered for a Pell Grant.

What are the requirements for a Pell Grant?

To be eligible for a Pell Grant, you must meet the following requirements:

- You must be a U.S. citizen or permanent resident.

- You must be enrolled in an eligible undergraduate degree or certificate program at an accredited college or university.

- You must have a high school diploma or equivalent.

- You must not have a bachelor’s degree.

- Your family income must be below a certain level.

What are the benefits of a Pell Grant?

Pell Grants are a great way to help pay for college. They are free money that does not have to be repaid, and they can help you cover the cost of tuition, fees, books, and living expenses. Pell Grants can also help you reduce your student loan debt.

What are the disadvantages of a Pell Grant?

There are a few disadvantages to Pell Grants. First, the amount of the grant you receive is based on your family income, so if your family income is high, you may not qualify for a Pell Grant. Second, Pell Grants are only available to undergraduate students, so if you are a graduate student, you will not be eligible for a Pell Grant.

What are the alternatives to a Pell Grant?

If you are not eligible for a Pell Grant, there are a few other financial aid options available to you. These include federal student loans, private student loans, and scholarships.

How do I use a Pell Grant?

Pell Grants can be used to pay for tuition, fees, books, and living expenses. You can use your Pell Grant at any college or university that is eligible for federal student aid.

FAQ

- Q: What is the difference between a Pell Grant and a loan?

- A: A Pell Grant is a free grant that does not have to be repaid, while a loan is money that you borrow and must repay with interest.

- Q: How long can I receive a Pell Grant?

- A: You can receive a Pell Grant for up to 12 semesters or 6 years, whichever comes first.

- Q: What happens if I drop out of school?

- If you drop out of school, you may have to repay some or all of your Pell Grant.

| Feature | Pell Grant | Federal Student Aid | Financial Aid | College Scholarships | Financial Assistance |

|---|---|---|---|---|---|

| What it is | A federal grant that helps pay for college or other post-secondary education | A program that provides financial assistance to students who are attending college or other post-secondary education | Money or other resources that help pay for college or other post-secondary education | A monetary award given to students who demonstrate financial need | Money or other resources that help people pay for basic needs such as food, housing, and healthcare |

| Eligibility | Must be a U.S. citizen or eligible noncitizen, have a high school diploma or equivalent, and be enrolled in an eligible program at least half-time | Must be a U.S. citizen or eligible noncitizen, be enrolled in an eligible program at least half-time, and demonstrate financial need | Must be a student who is enrolled in an eligible program, have a financial need, and meet other eligibility criteria | Must be a student who demonstrates financial need | Must be a person who is experiencing financial hardship |

| How much money | $6,495 (for the 2022-2023 academic year) | $5,500 (for the 2022-2023 academic year) | $5,865 (for the 2022-2023 academic year) | $2,500 (for the 2022-2023 academic year) | $1,174 (for the 2022-2023 academic year) |

| How to apply | Complete the Free Application for Federal Student Aid (FAFSA) | Complete the Free Application for Federal Student Aid (FAFSA) | Complete the Free Application for Federal Student Aid (FAFSA) | Complete the Free Application for Federal Student Aid (FAFSA) | Contact your local social services agency |

| Requirements | Must be a U.S. citizen or eligible noncitizen, have a high school diploma or equivalent, and be enrolled in an eligible program at least half-time | Must be a U.S. citizen or eligible noncitizen, be enrolled in an eligible program at least half-time, and demonstrate financial need | Must be a student who is enrolled in an eligible program, have a financial need, and meet other eligibility criteria | Must be a student who demonstrates financial need | Must be a person who is experiencing financial hardship |

I. What is a Pell Grant?

A Pell Grant is a type of federal financial aid that is awarded to undergraduate students who demonstrate financial need. Pell Grants are not loans, so they do not have to be repaid. The amount of a Pell Grant that you receive is based on your family’s income and the cost of attendance at your school.

II. Who is eligible for a Pell Grant?

To be eligible for a Pell Grant, you must be a U.S. citizen or eligible noncitizen, enrolled in an eligible degree or certificate program at an accredited college or university, and demonstrate financial need.

III. How much is a Pell Grant?

The maximum Pell Grant award for the 2022-2023 academic year is $6,495. The amount of your Pell Grant award will depend on your family’s income and the cost of attendance at your school.

IV. How do I apply for a Pell Grant?

To apply for a Pell Grant, you must complete the Free Application for Federal Student Aid (FAFSA). The FAFSA is available online at fafsa.gov. You must submit your FAFSA by the priority deadline for your school to be considered for federal financial aid, including Pell Grants.

V. What are the requirements for a Pell Grant?

To be eligible for a Pell Grant, you must meet the following requirements:

- You must be a U.S. citizen or eligible noncitizen.

- You must be enrolled in an eligible degree or certificate program at an accredited college or university.

- You must demonstrate financial need.

VI. What are the benefits of a Pell Grant?

Pell Grants can provide a significant amount of financial assistance to help you pay for college. Pell Grants are also not loans, so you do not have to repay them.

VII. What are the disadvantages of a Pell Grant?

The main disadvantage of a Pell Grant is that the amount of the award is limited. The maximum Pell Grant award for the 2022-2023 academic year is $6,495. This may not be enough to cover all of your college expenses.

VIII. What are the alternatives to a Pell Grant?

There are a number of other financial aid options available to help you pay for college. Some of these options include federal student loans, state student aid, and scholarships.

IX. How do I use a Pell Grant?

Pell Grants can be used to pay for a variety of college expenses, including tuition, fees, books, and living expenses. You can use your Pell Grant to pay for any eligible expense that is charged to your student account.

X. FAQ

Q: What is the difference between a Pell Grant and a loan?

A: A Pell Grant is a type of federal financial aid that is awarded to undergraduate students who demonstrate financial need. Pell Grants are not loans, so they do not have to be repaid. A loan is a type of financial aid that must be repaid with interest.

Q: How much does a Pell Grant cover?

The amount of a Pell Grant that you receive is based on your family’s income and the cost of attendance at your school. The maximum Pell Grant award for the 2022-2023 academic year is $6,495.

Q: How long can I receive a Pell Grant?

You can receive a Pell Grant for up to 12 semesters or 6 years of undergraduate study.

Q: What happens if I drop out of college?

If you drop out of college, you may have to repay some or all of your Pell Grant. The amount of the repayment will depend on how many credits you completed.

Q: What if I don’t qualify for a Pell Grant?

What is a Pell Grant?

A Pell Grant is a federal grant that helps pay for college or career school costs. It is awarded based on financial need, and does not have to be repaid.

I. What is a Pell Grant?

A Pell Grant is a type of federal financial aid that is awarded to undergraduate students who demonstrate financial need. Pell Grants are awarded on a first-come, first-served basis, and the amount of the grant that you receive is based on your family’s income and other financial circumstances.

II. Who is eligible for a Pell Grant?

To be eligible for a Pell Grant, you must be a U.S. citizen or eligible noncitizen, and you must be enrolled in an eligible undergraduate degree or certificate program at an accredited college or university. You must also meet certain income requirements.

III. How much is a Pell Grant?

The maximum Pell Grant award for the 2022-2023 academic year is $6,495. The amount of the Pell Grant that you receive will depend on your family’s income and other financial circumstances.

IV. How do I apply for a Pell Grant?

You can apply for a Pell Grant by filling out the Free Application for Federal Student Aid (FAFSA). The FAFSA is available online at fafsa.gov.

V. What are the requirements for a Pell Grant?

To be eligible for a Pell Grant, you must meet the following requirements:

- You must be a U.S. citizen or eligible noncitizen.

- You must be enrolled in an eligible undergraduate degree or certificate program at an accredited college or university.

- You must have a high school diploma or equivalent.

- You must meet certain income requirements.

VI. What are the benefits of a Pell Grant?

Pell Grants are a great way to help pay for college. They are free money that does not have to be repaid, and they can help you cover the cost of tuition, fees, books, and other expenses. Pell Grants can also help you make up the difference between the cost of attendance and your financial aid package.

VII. What are the disadvantages of a Pell Grant?

There are a few disadvantages to Pell Grants that you should be aware of. First, Pell Grants are awarded on a first-come, first-served basis, so you may not receive a Pell Grant if you apply too late. Second, the amount of the Pell Grant that you receive is based on your family’s income and other financial circumstances. This means that students from families with higher incomes will receive smaller Pell Grants than students from families with lower incomes.

VIII. What are the alternatives to a Pell Grant?

There are a number of other financial aid options available to students who are not eligible for a Pell Grant. These options include federal student loans, private student loans, scholarships, and grants.

IX. How do I use a Pell Grant?

Pell Grants can be used to cover the cost of tuition, fees, books, and other expenses related to your college education. You can use your Pell Grant to pay for any eligible expense, as long as it is directly related to your education.

X. FAQ

Q: What is the difference between a Pell Grant and a scholarship?

A: A Pell Grant is a type of federal financial aid that is awarded to students who demonstrate financial need. A scholarship is a type of financial aid that is awarded to students based on their academic merit or other criteria.

Q: How many Pell Grants can I receive?

You can receive up to 12 Pell Grants during your undergraduate career.

Q: Can I get a Pell Grant if I am a graduate student?

No, Pell Grants are only available to undergraduate students.

Q: Can I get a Pell Grant if I am attending a private college or university?

Yes, you can get a Pell Grant if you are attending a private college or university. However, the amount of the Pell Grant that you receive will be based on your family’s income and other financial circumstances.

What is a Pell Grant?

A Pell Grant is a federal grant that helps pay for college or other post-secondary education. It is awarded based on financial need, and does not need to be repaid.

Who is eligible for a Pell Grant?

To be eligible for a Pell Grant, you must be a U.S. citizen or eligible noncitizen, and you must have a high school diploma or equivalent. You must also meet certain income requirements.

How much is a Pell Grant?

The amount of Pell Grant you receive depends on your financial need and the cost of attendance at your school. The maximum Pell Grant for the 2022-2023 academic year is $6,495.

How do I apply for a Pell Grant?

To apply for a Pell Grant, you must fill out the Free Application for Federal Student Aid (FAFSA). The FAFSA is available online at studentaid.gov/fafsa.

What are the requirements for a Pell Grant?

To be eligible for a Pell Grant, you must meet the following requirements:

- Be a U.S. citizen or eligible noncitizen

- Have a high school diploma or equivalent

- Meet certain income requirements

What are the benefits of a Pell Grant?

Pell Grants have a number of benefits, including:

- They are free money that does not need to be repaid

- They can help you cover the cost of tuition, fees, books, and other expenses

- They can help you make college more affordable

What are the disadvantages of a Pell Grant?

Pell Grants have a few disadvantages, including:

- The amount of Pell Grant you receive is limited

- You must meet certain eligibility requirements

- The Pell Grant is not renewable

What are the alternatives to a Pell Grant?

There are a number of alternatives to a Pell Grant, including:

- Federal student loans

- State and local student aid programs

- Scholarships and grants

- Work-study programs

How do I use a Pell Grant?

Pell Grants can be used to pay for a variety of college expenses, including:

- Tuition and fees

- Books and supplies

- Room and board

- Transportation

- Other expenses

FAQ

- Q: What is the difference between a Pell Grant and a loan?

- A: A Pell Grant is a free grant that does not need to be repaid, while a loan is money that must be repaid with interest.

- Q: How much can I borrow in Pell Grants?

- The maximum Pell Grant for the 2022-2023 academic year is $6,495.

- Q: What happens if I don’t qualify for a Pell Grant?

- If you don’t qualify for a Pell Grant, you may be eligible for other federal student aid programs, such as federal student loans or work-study programs.

What is a Pell Grant?

A Pell Grant is a federal grant awarded to undergraduate students who demonstrate financial need. Pell Grants are the largest source of federal student aid, and they can help students cover the cost of tuition, fees, books, and living expenses.

Who is eligible for a Pell Grant?

To be eligible for a Pell Grant, you must be a U.S. citizen or permanent resident, and you must have a high school diploma or equivalent. You must also be enrolled in an eligible undergraduate degree or certificate program at a college or university.

How much is a Pell Grant?

The amount of Pell Grant you receive depends on your financial need and the cost of attendance at your school. The maximum Pell Grant for the 2022-2023 academic year is $6,495.

How do I apply for a Pell Grant?

To apply for a Pell Grant, you must fill out the Free Application for Federal Student Aid (FAFSA). The FAFSA is available online at fafsa.gov.

What are the requirements for a Pell Grant?

To be eligible for a Pell Grant, you must meet the following requirements:

- You must be a U.S. citizen or permanent resident.

- You must have a high school diploma or equivalent.

- You must be enrolled in an eligible undergraduate degree or certificate program at a college or university.

- You must demonstrate financial need.

What are the benefits of a Pell Grant?

Pell Grants have a number of benefits, including:

- They are free money that you do not have to repay.

- They can help you cover the cost of tuition, fees, books, and living expenses.

- They can help you make progress toward your degree or certificate.

What are the disadvantages of a Pell Grant?

There are a few disadvantages to Pell Grants, including:

- The amount of Pell Grant you receive is limited.

- You must meet certain eligibility requirements to receive a Pell Grant.

- Pell Grants are not renewable, so you must reapply each year to continue receiving them.

What are the alternatives to a Pell Grant?

There are a number of other financial aid options available to students, including:

- Federal student loans

- State student loans

- Private student loans

- Scholarships

- Grants

How do I use a Pell Grant?

Pell Grants can be used to cover the cost of tuition, fees, books, and living expenses. You can use your Pell Grant at any college or university that is eligible to participate in the federal student aid program.

FAQ

Q: What is the difference between a Pell Grant and a loan?

A: A Pell Grant is a free grant that you do not have to repay, while a loan is money that you borrow and must repay with interest.

Q: How long can I receive Pell Grants?

You can receive Pell Grants for up to 12 semesters or until you complete your degree or certificate program, whichever comes first.

Q: Can I receive a Pell Grant if I am a graduate student?

No, Pell Grants are only available to undergraduate students.

Q: What happens if I drop out of school?

If you drop out of school, you may have to repay any Pell Grant money that you have already received.

Q: Where can I get more information about Pell Grants?

VII. What are the disadvantages of a Pell Grant?

There are a few disadvantages to consider before accepting a Pell Grant.

- Pell Grants are not renewable. This means that you can only receive them for a certain number of years, typically four.

- Pell Grants are not awarded to students who are enrolled in less than half-time. This means that you must be taking at least 12 credits per semester to qualify for a Pell Grant.

- Pell Grants are not taxed. However, the money you receive from a Pell Grant may affect your eligibility for other forms of financial aid, such as scholarships and loans.

It is important to weigh the advantages and disadvantages of a Pell Grant before deciding whether or not to accept one. If you are eligible for a Pell Grant, it can be a great way to help pay for college. However, it is important to understand the limitations of a Pell Grant so that you can make the most of it.

Alternatives to a Pell Grant

There are a number of alternatives to a Pell Grant that students can consider when paying for college. These include:

- Federal student loans

- State student loans

- Private student loans

- Scholarships and grants

- Work-study programs

Each of these options has its own advantages and disadvantages, so it is important to weigh the pros and cons carefully before making a decision.

Federal student loans are offered by the U.S. Department of Education and are typically the most affordable option. However, they do come with interest charges, which can add up over time.

State student loans are offered by state governments and may be more affordable than federal loans. However, they may also have more restrictive eligibility requirements.

Private student loans are offered by private lenders and can be more expensive than federal or state loans. However, they may offer more flexibility in terms of repayment terms.

Scholarships and grants are awarded based on merit or financial need and do not have to be repaid. However, they are often competitive and may not be available to everyone.

Work-study programs allow students to earn money while they are in school. This can help to offset the cost of tuition and other expenses.

It is important to note that each of these options has its own advantages and disadvantages, so it is important to weigh the pros and cons carefully before making a decision.

IX. How do I use a Pell Grant?

Once you have received a Pell Grant, you can use it to pay for any eligible college expenses, including tuition, fees, books, supplies, and room and board. You can also use your Pell Grant to pay for expenses related to your course of study, such as transportation, child care, and medical expenses.

To use your Pell Grant, you will need to provide your college or university with your award letter. Your college or university will then apply your Pell Grant to your tuition and fees, and any remaining funds will be disbursed to you in the form of a refund.

If you have any questions about how to use your Pell Grant, you should contact your college or university financial aid office.

Pell Grant

-

What is a Pell Grant?

-

Who is eligible for a Pell Grant?

-

How much is a Pell Grant?

FAQ

* What is a pell grant loan?

A pell grant loan is a type of federal student aid that is awarded to undergraduate students who demonstrate financial need. Pell grants do not have to be repaid.

* What are the federal student aid?

Federal student aid is financial assistance that is offered by the U.S. government to help students pay for college. Federal student aid can come in the form of grants, loans, and work-study programs.

* What are college scholarships?

College scholarships are financial awards that are given to students to help them pay for college. Scholarships are typically awarded based on academic merit, financial need, or a combination of the two.

* What is financial assistance?

Financial assistance is any type of financial help that is given to students to help them pay for college. Financial assistance can come in the form of grants, loans, scholarships, or work-study programs.