I. Hedge Fund Definition

II. Types of Hedge Funds

III. How Hedge Funds Work

IV. Hedge Fund Strategies

V. Hedge Fund Performance

VI. Hedge Fund Regulation

VII. Hedge Fund Fees

VIII. Hedge Fund Investing

IX. Hedge Fund Startup

X. FAQ

| Feature | Hedge Fund | Investment Fund | Private Equity | Alternative Investment | Risk Management |

|---|---|---|---|---|---|

| Investment objective | Absolute return | Relative return | Capital appreciation | Risk-adjusted return | Risk mitigation |

| Investment strategy | Long/short | Buy and hold | Leveraged buyout | Distressed debt | Hedging |

| Regulation | SEC | FINRA | SEC | CFTC | NA |

| Liquidity | Daily | Monthly | Annual | Illiquid | Daily |

| Fees | 2%+20% | 1%-2% | 2%-20% | 20%+ | NA |

II. Types of Hedge Funds

There are many different types of hedge funds, each with its own unique investment strategy and risk profile. Some of the most common types of hedge funds include:

- Funds of funds: These funds invest in other hedge funds, providing investors with a diversified exposure to the hedge fund industry.

- Long/short equity funds: These funds take long positions in stocks that they believe are undervalued and short positions in stocks that they believe are overvalued.

- Convertible arbitrage funds: These funds trade convertible bonds, which are bonds that can be converted into shares of stock.

- Distressed debt funds: These funds invest in debt securities of companies that are in financial distress.

- Event-driven funds: These funds invest in companies that are undergoing significant changes, such as mergers, acquisitions, or bankruptcy filings.

The different types of hedge funds offer investors a variety of investment options with different risk and return profiles. It is important to carefully consider your investment goals and risk tolerance before investing in a hedge fund.

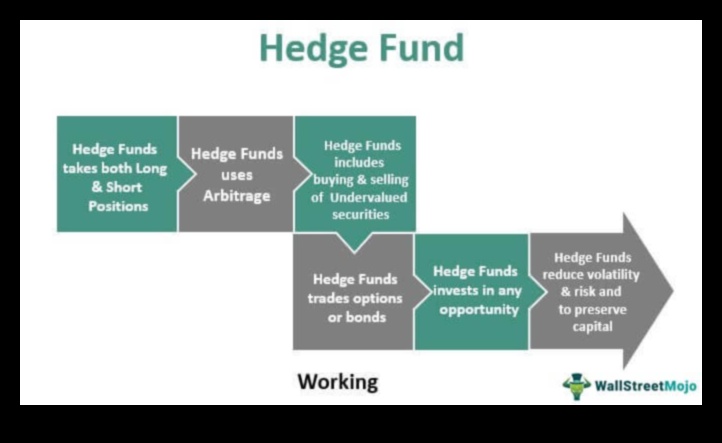

III. How Hedge Funds Work

Hedge funds use a variety of strategies to generate returns for their investors. These strategies can be broadly classified into two categories:

-

Market-neutral strategies seek to generate returns by exploiting inefficiencies in the market. This can be done by taking long positions in stocks that are expected to outperform the market and short positions in stocks that are expected to underperform the market.

-

Non-market-neutral strategies seek to generate returns by taking directional bets on the market. This can be done by taking long positions in stocks that are expected to rise in value and short positions in stocks that are expected to fall in value.

Hedge funds typically use a combination of both market-neutral and non-market-neutral strategies in order to maximize their returns and minimize their risk.

4. Hedge Fund Definition

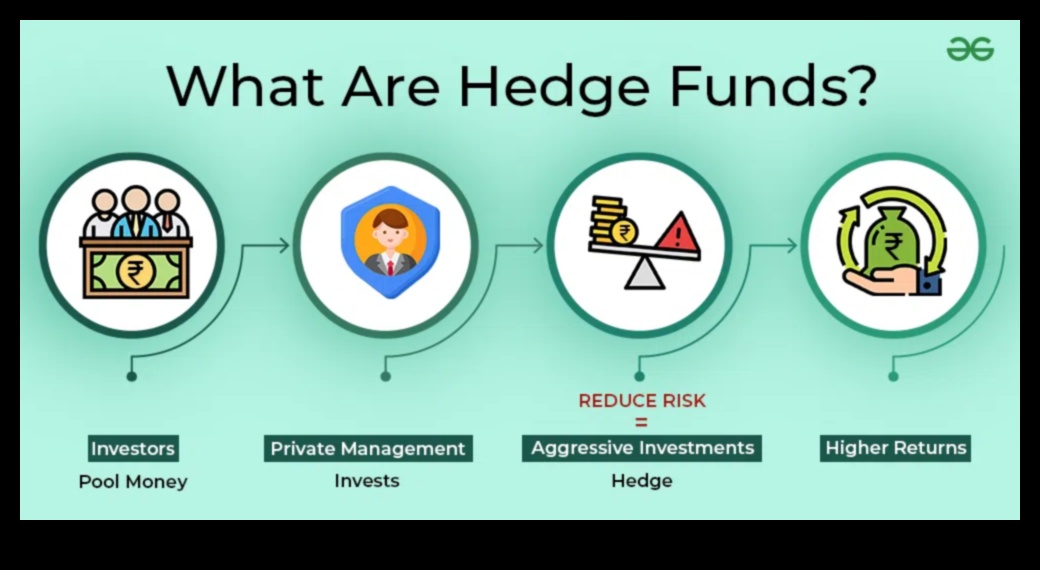

A hedge fund is an investment fund that uses a variety of strategies (including but not limited to leveraging, short selling, and derivatives) to achieve its investment objectives. Hedge funds typically have high minimum investment requirements and are only available to accredited investors.

Hedge funds are often used by institutional investors and high-net-worth individuals to generate returns that are not correlated to the performance of the stock market. However, hedge funds can also be risky investments, and investors should carefully consider the risks before investing in them.

Some of the benefits of investing in hedge funds include:

- Potential for high returns

- Diversification from traditional investments

- Access to experienced investment managers

Some of the risks of investing in hedge funds include:

- High fees

- Leverage and short selling can increase risk

- Illiquidity

- Unpredictable performance

Response format is unexpected.

6. Hedge Fund Definition

A hedge fund is a type of investment fund that uses a variety of strategies to generate returns for its investors. Hedge funds typically invest in a wide range of assets, including stocks, bonds, commodities, and derivatives. They may also use leverage to amplify their returns.

Hedge funds are typically structured as limited partnerships, with the general partner responsible for managing the fund and the limited partners providing the capital. The general partner typically receives a management fee and a performance fee based on the fund’s returns.

Hedge funds are often considered to be alternative investments, as they are not subject to the same regulations as traditional mutual funds. This gives them more flexibility to invest in illiquid assets and use more complex strategies.

Hedge funds can be a good investment for investors who are looking for high returns and are willing to accept the risks associated with these investments. However, it is important to remember that hedge funds are not without risk, and investors should carefully consider their investment objectives and risk tolerance before investing in a hedge fund.

VII. Hedge Fund Fees

Hedge funds typically charge a management fee of 2% of assets under management and a performance fee of 20% of profits. The management fee is charged on a quarterly basis, while the performance fee is charged only when the fund generates a positive return.

The management fee is a way for the hedge fund manager to cover their costs, such as salaries, rent, and marketing. The performance fee is a way for the manager to share in the profits of the fund with the investors.

Hedge fund fees can vary significantly from fund to fund. Some funds charge higher fees than others, and some funds charge performance fees that are a higher percentage of profits. Investors should carefully consider the fees charged by a hedge fund before investing in it.

Hedge fund fees can be a significant expense for investors, so it is important to understand how they work before investing in a hedge fund. Investors should also be aware that hedge funds can lose money, and that the fees charged by a hedge fund can eat into any profits that are generated.

Hedge Fund Investing

Hedge fund investing is the process of investing in hedge funds. Hedge funds are private investment funds that use a variety of strategies to generate returns for their investors. These strategies can include long-short equity, market neutral, and event-driven investing. Hedge funds are typically only available to accredited investors, and they often have high minimum investment requirements.

There are a number of benefits to investing in hedge funds. First, hedge funds can provide diversification benefits to a portfolio. Hedge funds can also generate higher returns than traditional investments, such as stocks and bonds. However, hedge funds also come with some risks. Hedge funds are often more volatile than traditional investments, and they can lose money.

If you are considering investing in hedge funds, it is important to do your research and understand the risks and rewards involved. You should also make sure that you are eligible to invest in hedge funds.

Hedge Fund Startup

Hedge fund startup is the process of creating a new hedge fund. It involves raising capital, hiring staff, and developing a trading strategy.

The first step in starting a hedge fund is to raise capital. This can be done by approaching accredited investors, such as high-net-worth individuals and institutions. The amount of capital needed to start a hedge fund will vary depending on the size of the fund and the trading strategy that will be used.

Once capital has been raised, the next step is to hire staff. This will include a fund manager, traders, analysts, and support staff. The fund manager will be responsible for making investment decisions, while the traders will execute trades and the analysts will provide research.

The final step in starting a hedge fund is to develop a trading strategy. This will involve identifying market opportunities and developing a plan for how to trade them. The trading strategy will vary depending on the type of hedge fund that is being created.

Starting a hedge fund can be a challenging and time-consuming process. However, it can also be a rewarding one. If successful, a hedge fund can generate significant returns for its investors.

X. FAQ

Q: What is a hedge fund?

A: A hedge fund is an investment fund that uses a variety of strategies to try to achieve positive returns in both rising and falling markets.

Q: What are the different types of hedge funds?

A: There are many different types of hedge funds, but some of the most common include:

- Long/short equity funds

- Event-driven funds

- Distressed debt funds

- Funds of funds

Q: How do hedge funds work?

Hedge funds use a variety of strategies to try to achieve positive returns in both rising and falling markets. Some of the most common strategies include:

- Long/short equity: This strategy involves buying stocks that are expected to rise in value and shorting stocks that are expected to fall in value.

- Event-driven: This strategy involves investing in companies that are undergoing major changes, such as mergers or acquisitions.

- Distressed debt: This strategy involves investing in debt of companies that are in financial distress.

- Funds of funds: This strategy involves investing in a variety of other hedge funds.